Historical

traces

A foreign currency swap, commonly known as an FX swap, isan agreement between two foreign parties to exchange currencies. The agreement entails exchangingprincipal and interestpayments on a loan in one currency for principal and interest payments ona loan in another currency of equal value.

When a trade is held open overnight, a swap rate is creditedor debited as a rollover interest rate.When a position isrolled over,the swap rate is credited or debited once for each day of the week.

Japanese Candlestick techniques, which are based on militarytactics of the period, have given traders an advantage longbefore bar and point and figure charts, while evolving into anappealing strategy for today’s quick and unpredictable markets.

What are the benefitsof using Japanese candlesticks?

The following are three compelling reasons to employ Japanesecandlesticks:

Dynamic visual effects

Japanese Candlesticks are more clear, visible, and attractive to theeye than other charting tools, providing an x-rayperspective of price movements andemotional health of their chosen market to anyone from a novice to a seasoned veteran. This can beused to assess howthe market perceives important fundamental events.

Techniques of Technical Analysis are improved

Most other Technical Analysis techniques, such as classic trend,pattern, and momentum analysis, as well as themoresophisticated Ichimoku Kinko Hyo or Demark Indicators, complement Japanese Candlesticks. This isdue to the factthat candlestick charts and bar charts both employ the samefour trading cycle data points: open, high, low, and close.

Timing is everything

Japanese Candlesticks are a one-of-a-kind leading indicator thatproduces improved trading entry and exit timing.Reversal signals may be supplied in just a few sessions, giving it a significant advantage over otherprocedures thatcan take weeks. This is why Japanese Candlestick methods are a more appealing tactic in today’sfast-paced and volatilemarkets.

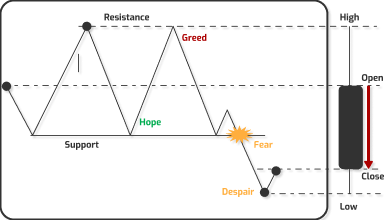

Price psychology and intrinsic price movement

A Bearish or Black Candlestickis an illustration of intrinsic price movements and psychology thatis condensed in theline chart above.

During the first session, the price drops, making a low, beforefinally rising and doubling in value. The numberof purchasers in the market decreases at this extreme high point, providing a vacuum for prices tocollapse andretraceto the previous low, which has become psychologically ingrained in our minds.

Market players are subject to a cycle of human emotions that isguided by their profit and loss performance(hope, greed and fear).

Assuming we are buyers, we have “hope” for a resurgence higher fromsupport, “greed” for the secondprofitable run, with instinctive expectations of a new high, and, last but not least, “fear” ofpotentially “getting itwrong” as price fails at resistance, and “despair” of the unknown as price accelerates downwardthroughsupport, eventually capitulating into uncharted territory.

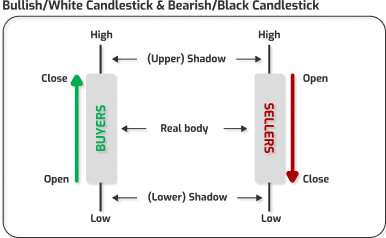

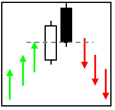

Candlestick Construction

A Bearish or Black Candlestickis an illustration of intrinsic price movements and psychology thatis condensed in theline chart above.

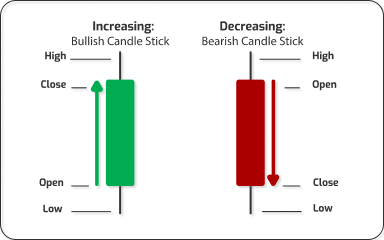

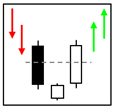

Bullish or White Candlestick

Indicates that the session’s closing price was higher than thesession’s opening price. This indicates that purchaserskept control and spent more time lobbying for higher prices.

Bearish or Black Candlestick

Indicates that the session’s opening price was higher than thesession’s closing price. This indicates that vendors keptcontrol and spent more time pressing for a lower price..

Bearish or Black Candlestick

The “real body” is the rectangle area of the Candlestick that sitsbetween the open and closingsessions. The “true body” symbolizes total market commitment and “essence market psychology,”as described by Japanese chartists.

Shadows (upper/lower)

The thin lines extending out from the Bullish/White or Bearish/BlackCandlestick “realbodies” are referred to as “shadows” (upper/lower) and indicate the session’s extremes. The “shadows”alsoreveal where momentum has been shifted.

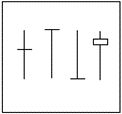

The Doji (Doji Bike)

Signal

Indecisiveness, susceptibility, and uncertainty are allsignals that can be neutral or cause a reversal.

Prerequisites

The open and close are at or close to the same level.

Consequence

It is crucial in spotting market tops since it is asymptom of an ambivalent market, when buyers and sellersare in a state of equilibrium. In fluctuating markets, where it is just confirming atrendless situation, it hasless significance.

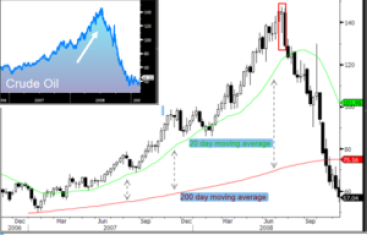

Fig 1. With both the 20 and 200 day moving averagesdemonstrating expanding divergence, a Doji marks the pinnacle ofCrude Oil’s spectacular ascent.

Hammer (Takuri)

Signal

When observed in a downtrend, this represents a bullishreversal.

Prerequisites

Must be located in a downtrend.

Lower shadows are usually at least twice as longas the real body, which should be at thecandle’s peak.

Lower shadows are usually at least twice as longas the real body, which should be at thecandle’s peak.

Consequence

The market appears to be “hammering out” a bottom.Thelower shadow denotes a negative outcome. a price level isrejected.

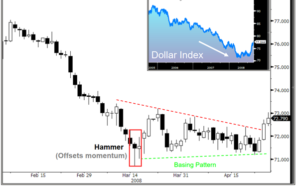

Fig 2. Following an extended drop in the Dollartrade-weighted index, Hammer makes a crucial low.Following that, abottoming pattern appears, indicating that the market is recovering.

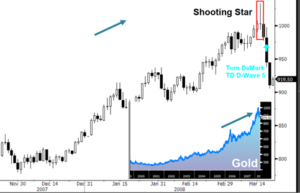

Shooting Star (Nagare Boshi)

Signal

Bearish reversal.

Prerequisites

It must be in an upward trend.

The length of the upper shadow should be at least twice that of the true body, whichshould be at the bottom of thecandle.

The length of the upper shadow should be at least twice that of the true body, whichshould be at the bottom of thecandle.

Consequence

The engulfing indicates a transition ofpower betweenbuyers and sellers, with thewinner overwhelms the previous trend.

Symbolizes “trouble overhead.” The higher shadow showsa price level’s rejection to the upside.Gaps should ideally beapart from the previous genuine body, however this is not required.

Hanging Man (Karakasa)

Signal

Bearish reversal.

Prerequisites

It must be in an upward trend.

Lower shadows are usually at least twiceas long as the real body, which should be at thecandle’s peak.

A bearish candle must fall within 50% of the original risingsession to confirm thefollowing session.

Lower shadows are usually at least twiceas long as the real body, which should be at thecandle’s peak.

A bearish candle must fall within 50% of the original risingsession to confirm thefollowing session.

Consequence

The uptrend was the driving factor, tempting a gaphigher. However, sellers seize control and set an intraday low.Before the close of trading,buyers reverse the trend and push the price upward. Thefollowing session’s bearish candleconfirms reversal.

Fig 4. Following a breakthrough from a risingmulti-month trend-channel, the Hanging Man signals an important top in USLong-Term Government Yields.

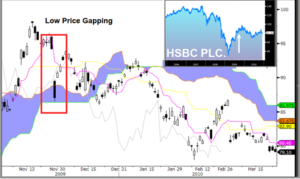

High Price Gapping Play/Low Price Gapping Play

Signal

Bullish continuation when gaps up.

Bearish continuation when gaps down.

Bearish continuation when gaps down.

Prerequisites

Price action is congested near its highs (high pricegapping) or lows (low price gapping),stabilizing the prevailingtrend, and then gapping farther in the existing trend’s direction.

Second real body (open & close) engulfs priorsession’s real body, not necessarily theshadow.

Second real body (open & close) engulfs priorsession’s real body, not necessarily theshadow.

Consequence

The gap is described as a move out, either up or down,thatcontinues the trend’s direction. It is the ability to breakfree from a restraint period that has been imposed.

Fig 5. The Russian Ruble is in a significant downwardtrend on the chart. Price took a brief halt here to gathermomentum. Price gaps down after breaking through the support line that defines the bottom ofthe consolidationperiod,beginning the current bearish trend with increased vigour.

Belt Hold Line (Yorikiri)

Signal

After a downtrend, a bullish belt hold opens on the lowand closes at or around the top of the candle.

After a previous upswing, a bearish belt hold opens on high and finishes at or aroundlow of candle.

After a previous upswing, a bearish belt hold opens on high and finishes at or aroundlow of candle.

Prerequisites

The body must be the opposite colour of the currenttrend.

There must be a considerable gap, no shadow at open and a markedly long body.

There must be a considerable gap, no shadow at open and a markedly long body.

Consequence

Most essential if they are preceded by a prevailingtrend and confirm resistance on the next day’s close. Yorikiri isaJapanese sumo wrestling phrase that means “push your opponent out of the ring whileholding on to his belt.”

Fig 6 The euro opened sharply higher than the previousday’s close, then retreated forthe remainder of the day, closingon a lengthy bearish candle.

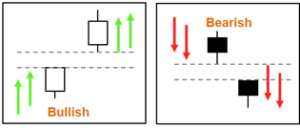

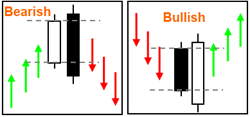

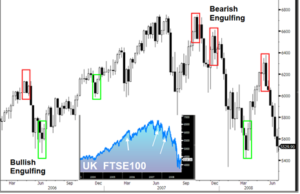

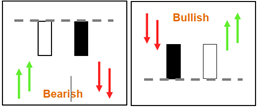

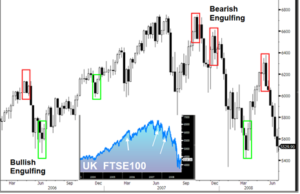

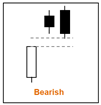

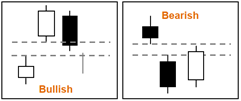

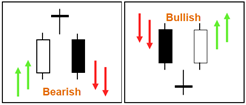

Engulfing (Tsutsumi)

Signal

Bearish reversal when found in an uptrend.

Bullish reversal when found in a downtrend.

Bullish reversal when found in a downtrend.

Prerequisites

Important to be located within respectivetrend (see above).

Second real body (open & close) engulfs priorsession’s real body, not necessarily the shadow.

For bullish engulfing, the second candle mustbe white, whereas for bearish engulfing, thesecond candle must be black.

Second real body (open & close) engulfs priorsession’s real body, not necessarily the shadow.

For bullish engulfing, the second candle mustbe white, whereas for bearish engulfing, thesecond candle must be black.

Consequence

The engulfing indicates a transition ofpower between buyers and sellers, with thewinner overwhelms the previous trend.

Fig 7. A sequence of (Bearish/Bullish) Engulfingsignals on the UK’s FTSE Stock Market at keyswing points.

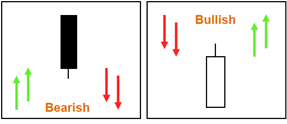

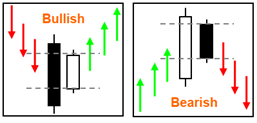

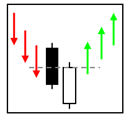

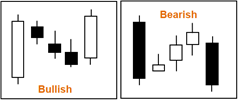

Harami (Harami)

Signal

Bullish reversal when found in a downtrend.

Bearish reversal when found in an uptrend.

Bearish reversal when found in an uptrend.

Prerequisites

The second real body is small and is confinedwithin the real body from the previous session.

Consequence

The dominant force is losing support and may be shifting in the wrong direction.The tendency is reversed when a pregnant or mother candle gives birth to a little candle.

Fig 8. Harami uses Tom DeMark’s TD-Combo signal to cut out crucial lowswithin an extreme market exhaustion cycle (9-13-9).

Piercing Line (Kirikomi)

Signal

Bullish reversal.

Prerequisites

It must be in a downward trend.

At the end of a downturn, there isa long bearish candle. The followingsession begins with a lower opening andsubsequently reverses to a higher opening,all within 50% of the previous session’s true body.

At the end of a downturn, there isa long bearish candle. The followingsession begins with a lower opening andsubsequently reverses to a higher opening,all within 50% of the previous session’s true body.

Consequence

The primary driver was the downtrend,which enticed prices to gap lower. However,there is a good reversal before the end of trading,which compensates the recent decrease. Sellers are left with doubts about their position.

Fig 9. After a steep decrease that temporarily punctures the lower BollingerBand, the bullish piercing line candle pattern reclaims control.

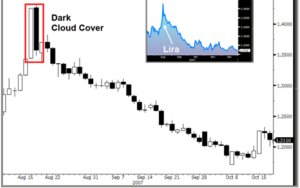

Dark Cloud Cover (Kabuse)

Signal

Bearish reversal.

Prerequisites

It has to be in an upward trend.

The end of the uptrend is marked by a long bullish candle.The subsequent session begins higher and eventually lower,with the real body remaining within 50% of the previous session’s.

The end of the uptrend is marked by a long bullish candle.The subsequent session begins higher and eventually lower,with the real body remaining within 50% of the previous session’s.

Consequence

The primary driver was the uptrend, which enticed prices to gaphigher. However, there is a negative reversal before the end oftrading, which cancels out the recent advance. Those who have beenwaiting for a chance to participate can finally do so.

Fig 10. At the apex of a rally and the start of a downward trend,the Dark Cloud Cover pattern appears.

Tweezer Top/Tweezer Bottom

Signal

A tweezer bottom indicates a bullish reversal in the short term.

Tweezer tops indicate a bearish reversal in the short term.

Tweezer tops indicate a bearish reversal in the short term.

Prerequisites

Two days in a row in which the high and low temperatures are the same.The candle’s colour is unimportant, and the tweezers can be made up of real bodies, shadows,and/or doji. Long first body, little second actual body is ideal.

Consequence

The engulfing indicates a transition ofpower between buyers and sellers, with thewinner overwhelms the previous trend.

Two successive highs or lows indicate the presence of support or resistance.In the second session, whatever force the market had in the first session is dissipating. In weekly/monthly charts, this is a particularly prominent pattern.

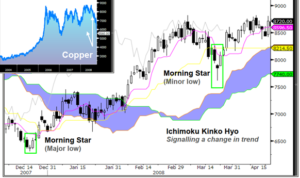

Morning Star (Sankawa Ake No Myojyo)

Signal

Bullish reversal.

Prerequisites

Must be located within a downtrend.

At the end of a downturn, a long bearish candle appears.

The next session has a limited range and likely to be lower.The next candle is a bullish long candle that rallies more than 50% of the previous bearish candle.

At the end of a downturn, a long bearish candle appears.

The next session has a limited range and likely to be lower.The next candle is a bullish long candle that rallies more than 50% of the previous bearish candle.

Consequence

The main motivator was the downward trend, which encouraged prices to drop. The brief session that follows, on the other hand, foreshadows a potential shift in opinion. In astrology, Mercury, the Morning Star Planet, appears before sunrise. Finally, the third session confirms the results of the prior two sessions and raises the bar.

Fig 12. Copper has morning star reversals at major and minor lows, with Ichimoku Kinko Hyo signaling a trend change.

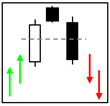

Evening Star (Sankawa Yoi No Myojyo)

Signal

When detected in an uptrend, this is a bearish reversal indicator.

Prerequisites

Must be located within an uptrend.

At the top of the upswing, there isa long bullish candle. The next sessionhas a small range and has a tendency to gaphigher. A bearish long candle follows, followedby a bearish short candle.

At the top of the upswing, there isa long bullish candle. The next sessionhas a small range and has a tendency to gaphigher. A bearish long candle follows, followedby a bearish short candle.

Consequence

The primary driver was the uptrend, which enticed pricesto gap higher. The following brief session, on the other hand,foreshadows a possible shift in attitude. The evening star planet“Venus” appears in astrology before nightfall. Finally, the thirdsession verifies the second and drives the price lower.

Fig 13. During the top formation on the S&P500 Index, there were a series of eveningstar reversals. As upside momentum weakens, the RSI momentum indicator confirms bearishdivergence on the lower axis.

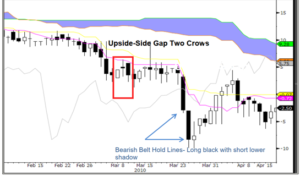

Upside-Gap Two Crows

Signal

A bearish pattern indicates a reversal to the upward.

Prerequisites

The first session begins with a long white candle, followed by a gaped-up black body. A third black flame, which engulfs the first day’s body, completes the pattern.

Consequence

The market is on an uptrend and has recently gapped up to a new all-time high. The market fails to maintain its position and is followed by two dark bodies that grow in length. The sellers gradually gain control. If price does not restore strength in the fourth session, the downside may prevail.

Fig 14. The upside gap two crows in the US 10-year swap spreads foreshadows an impending dip, which materializesonly one week later in the shape of two consecutive bearish candlesticks, confirming the upside exhaustion.

Three White Soldiers

Signal

After a downtrend or range-bound market, a bullish pattern signals strength.

Prerequisites

Three consecutive sessions of long white candlesticks, each closing at or near previous high. Each candle begins at or near the range of the body of the previous.

Consequence

Three long white candlestick sessions in a row, each closing at or around the preceding high.Each candle starts at or near the range of the previous candle’s body.

Fig 15. With a bullish harami, BB&T initially predicts a reversal of the prior downtrend (small white, following an engulfing white). Following that, a three white soldier pattern appears, signalling a shift in momentum to the upside, which is further reinforced by a positive MACD crossover.

Three Black Crows

Signal

Market correction is indicated by a bearish pattern.

Prerequisites

Three sessions of extended black candlesticks, each closing lower than the preceding and all at or near lows. Consecutive candles start inside the range of the previous candle’s body.

Second real body (open & close) engulfs priorsession’s real body, not necessarily the shadow.

Second real body (open & close) engulfs priorsession’s real body, not necessarily the shadow.

Consequence

The Three Black Crows pattern suggests a shift in selling pressure to the downside. The bodies are long and the shadows are little. The pattern is best suited for long-term traders who will wait for all three to complete to confirm a market correction.

Fig 15. With a bullish harami, BB&T signals the conclusion of the previous downtrend (small white, following an engulfing white). Following that, a three white soldier pattern appears, signaling a shift in momentum to the upside, which is supported by another strong MACD crossover.

Tasuki Gap

Signal

When tasuki gaps up, bullish continuation is likely.

When tasuki gaps down, bearish continuation is likely.

When tasuki gaps down, bearish continuation is likely.

Prerequisites

A bullish tasuki gaps up, then one white and one black candle, preferably of equal size, follows. The second black candle ignites within the physical body and then extinguishes below. A bearish tasuki gap is the polar opposite.

Consequence

In the third session, the gap does not close completely, indicating that the current trend will continue. If the gap is filled, however, support or resistance has been breached, and the optimistic or bearish mood has been nullified.

Fig 17. Price surges down towards the ichimoku cloud, attempting to break through, then pulls back with a sequence of white candlesticks filling the previous session’s gap in the chart above.

Gapping Side-by-Side White Lines

Signal

Pattern of bullish continuance.

Prerequisites

The first session is usually marked by a long white candlestick, which is followed by an open above the previous candlestick’s closing. The size of the second and third sessions is comparable, and both are white.

The gap between the first and second sessions is not closed by the end of the third session.

The gap between the first and second sessions is not closed by the end of the third session.

Consequence

In an upward trend, this pattern is the most important. This pattern indicates a continuance of the bullish bias in an already bullish situation.

Fig 18. In a sustained bear trend, the IBEX breaks through the ichimoku cloud, pauses for three short white inside bars, and then resumes on strong volume and extended black bodies.

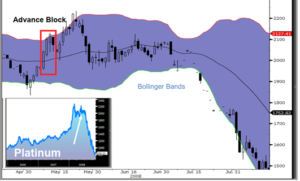

Advance Block

Signal

At the top of a clear uptrend, a bearish reversal signal arises.

Prerequisites

Three white candlesticks like three white soldiers, except the advancing block is always up trending.

The second and third sessions have extended upper shadows and open within the body of the previous session.

The second and third sessions have extended upper shadows and open within the body of the previous session.

Consequence

Each succeeding bull candle is weaker than the preceding, indicating that the previous upswing is losing momentum. The market is attempting unsustainable highs, and the shadows indicate a lack of position strength.

Fig 19. Platinum is struggling to achieve new highs as the uptrend comes to an end. Each candle opens within the body of the previous candle and shuts on progressively shorter body lengths. The failure swing on the upper Bollinger band confirms that a top has been formed and that a reversal is on the way.

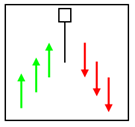

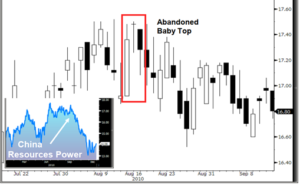

Abandoned Baby

Signal

In a downturn, a bullish reversal can be seen.

When observed in an uptrend, this represents a bearish reversal.

When observed in an uptrend, this represents a bearish reversal.

Prerequisites

They must fit with their distinct trends.

The second session is a doji that gaps in the trend’s direction, followed by a third session that gaps in the opposite direction of the first.

The second session is a doji that gaps in the trend’s direction, followed by a third session that gaps in the opposite direction of the first.

Consequence

In one final try, trend strength gaps, but a rapid change in momentum pulls price in the opposite direction.

Fig 20. In one final try, trend strength gaps, but a rapid change in momentum pulls price in the opposite direction.

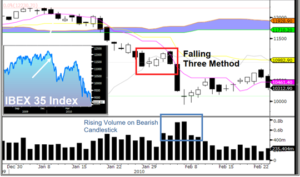

Rising Three Method/Falling Three Method

Signal

When “rising,” continue to be bullish.

When “falling,” bearish continuation is expected.

When “falling,” bearish continuation is expected.

Prerequisites

The first session is in the trend’s direction, followed by a series of 2-3 short-bodied sessions, ideally trading in the opposite direction of the trend, inside the first candle’s high-to-low range. Finally, a long body workout restores the previous trend’s orientation.

Consequence

Three Method is seen as a break from trading and combat. In Western chart patterns, it’s similar to a flag or pennant configuration. The first and last candlesticks should have the most volume.

Fig 21. In a sustained bear trend, the IBEX breaks through the ichimoku cloud, pauses for three short white inside bars, and then resumes on strong volume and extended black bodies.

FAQ

1. How do you determine whether a candle is bullish or bearish?

Colour combinations are used to code candlestick patternsin many differentways. The most popular colour combinationsareblack/white and red/green. It’s sometimes better tofocus about a candlestick’s construction logicratherthan its colorcoding. (See page 6 for details.)

A bullish (positive) session, for example, is one in which the market rises and ends higher than it opens. This suggests that the purchasers were in charge. The opposite is true for a bearish (negative) session where the market falls and closes lower > than its opening price.

A bullish (positive) session, for example, is one in which the market rises and ends higher than it opens. This suggests that the purchasers were in charge. The opposite is true for a bearish (negative) session where the market falls and closes lower > than its opening price.

2. What significance does the candlestick’s “true body” and shadow have?

The rectangle area of a candlestick, also known as the “true body,” accordingto Japanese candlestick analysts, is “theessence of market psychology,” as it is where the total commitment is retained. Meanwhile, the session’sextreme priceranges are shadows, which are thin vertical lines (candle “wick”). They are also significant andrepresent a yin-yangbalance. They show that the momentum has shifted.

3. What key principles should be used to confirm a candlestick signal?

Finding a confluence of signals to create the trade setting is critical, as itincreases the likelihood of a candlestickpattern’s success. This is where Eastern and Western approaches collide, combining basic filters such astrend andmomentum with more advanced Ichimoku Kinko Hyo or Demark Indicators.

After then, it’s best to wait for price confirmation and continuation over a certain level before makinga tradingchoice. Finally, each signal should have a favourable risk/reward profile in order to promote successfulmarketlifetime.

After then, it’s best to wait for price confirmation and continuation over a certain level before makinga tradingchoice. Finally, each signal should have a favourable risk/reward profile in order to promote successfulmarketlifetime.

4. What are the finest candlestick timeframes to use?

The beauty of Japanese candlesticks is that they may be used on any timeframe.In reality, we can considerably improvethe success rate of signals by using various timeframes to corroborate them. On the s/t scale, 15 minuteintraday chartsare reliable for sharpening entry/exit points, while weekly charts are useful for l/t confirmations.Mass psychology,liquidity, and underline volatility are the most important proponents.

5. What are the differences in candlesticks between markets?

There are modest variances in market characteristics. These include everythingfrom a market’s distinctive volatilitycharacteristic (which influences the size of a candlestick) to the open and closure defaults for thesession.

The Midmar Capital, for example, has trading hours that extend 24 hours in three separate time zones. On themajor currencypairings, most traders fall into one of three camps when deciding which close to use: I just defaultingto the nativeregion, such as the United States, Europe, or Asia. ii) Using a strategic foreign exchange closure thatis heavilyinfluenced by key economic events (this tends to be US centric). iii) Increased FX volume. Trading inLondon accountsfor 31% of total FX volume. The United States, on the other hand, accounts for only 19% of global FXvolume.

The Midmar Capital, for example, has trading hours that extend 24 hours in three separate time zones. On themajor currencypairings, most traders fall into one of three camps when deciding which close to use: I just defaultingto the nativeregion, such as the United States, Europe, or Asia. ii) Using a strategic foreign exchange closure thatis heavilyinfluenced by key economic events (this tends to be US centric). iii) Increased FX volume. Trading inLondon accountsfor 31% of total FX volume. The United States, on the other hand, accounts for only 19% of global FXvolume.

6. To confirm candlestick signals, which indicators should be used?

It’s best to use a variety of non-correlated indicators with a demonstratedtrack record if you want a high chance ofsuccess. One example would be to start with a momentum study that measures overbought/oversold extremes,such as RSI orStochastics. This is because the majority of candlestick signals are „reversal‟ oriented and soindicators thatanticipate reversals would work best.

7. When it comes to candlestick signs, how reliable are they?

There have been various studies on the accuracy of candlestick signals thathave been back-tested. The results will, ofcourse, vary according on the candle used, as well as the risk and money management profiles used.